PULSE MARKET UPDATE - April 2024

Commentary

It seems that the 2023 trade estimates regarding crop availability were a little on the high side.

Since the turn of the year pulse trade continued at a lower level than anticipated. Demand from core users has remained strong but supply has been somewhat harder to secure. Initially considered as reluctance of growers to sell it is now more simply believed that stocks are generally lower than had been estimated post-harvest.

While commodity values fell significantly in recent months, pulse values held firm. It was considered that these values would surely fall in the face of alternative protein source weakness, but they did not, and as wheat spot and futures prices have risen more recently on the back of supply and demand concerns, pulse values have risen a little further too.

Export demand to the EU has remained weaker in the face of these higher values but the prices are being maintained by domestic users who need to keep pulses in rations and the activities of short sellers recovering their positions.

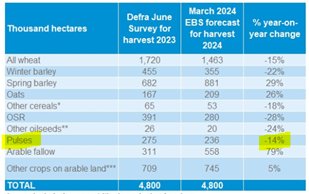

The situation for UK production from crop 2024 is very unclear. The biggest driver of uncertainty has been the awful soil conditions due to the prolonged wet weather that prevented a significant proportion of the winter crops being sown and has dramatically delayed spring sowing. Revised AHDB early bird figures in March suggested a 14% drop in pulse area intentions.

https://ahdb.org.uk/cereals-oilseeds/early-bird-survey

While the conditions are improving there is still plenty of land that has not been suitable to sow or has been drilled in less-than-ideal conditions and many growers will have reconsidered their options carefully.

SFI options have been touted as attractive to many but just what level of uptake is being absorbed and what impact this might have on pulse crop area is also unknown at this stage. Although pulse crop production provides a wide range of agronomic and environmental benefits in the rotation, current SFI options represent a clear additional threat in the current conditions.

UK Pulses

Feed Beans

Demand has remained strong from those buyers who ‘need’ beans. Apparently short against the available stocks, values have risen to over £265/t ex farm. Growers are either reluctant to sell and/or crop is in short supply.

Export interest in the EU has fallen away somewhat at high prices but domestic demand still exists for core users.

New crop trade is however thin and a little theoretical with few willing to forward sell off-farm crops that in many cases may have only just been sown, but for those willing current values remain. Prices of £255-£258/t ex farm might be offered as significant premium over November futures for feed wheat. Although at these levels alternative bi products such as DDGS and oilseed meals may return as a preference for winter ration formulators.

Human consumption bean exports

There is almost no activity in this market at present and suggestions of premiums non-existent. It does however look as though economic barriers to trade might be easing a little as payment systems appear to be improving, which will encourage traders.

UK combining peas

Canadian weather has recently impacted pea interest. Exceptionally dry and warm, it has raised questions among buyers about moisture availability during the season and doubts about crop 2024 yield potential. The 2023 crop was already short and a lower supply in 2024 could compound availability issues.

There are few domestic open market samples to be found, so the trade is reliant upon contracted production. Contracted peas for 2024 is apparently higher than for last year and despite the weather and soil conditions there is little row back being seen from earlier pre-winter enthusiasm.

A few contracts are available for any making late decisions to sow peas but choice of type is likely to be in the hands of the trader placing the contract.

Green peas

While contracts for spring sowing 2024 are still available it is starting to get late and little new interest is being shown. The range is £300 - £400/t ex farm with various optional clauses. Contact your merchant for varietal choice.

Old crop market values range from about £280- £325/t ex farm depending upon quality. While some much higher prices have been seen in recent weeks for small parcels of very high quality, these niche outlet buyers have now withdrawn from the market.

Marrowfat peas

Anyone holding marrowfat peas in the open market is likely to receive offers of around £500/t but as harvest approaches, offers may fall a little, depending upon perceived likely availability from new crop.

It is unlikely that any seed is now available to contract additional area for the 2024 crop.

Yellow peas

For samples with the best soaking and cooking qualities values are at an approximate discount to green peas of £20-£30/t. Few if any samples have been offered to the trade in recent weeks.

Maple peas

After months without interest or apparent availability buyers continue to find these peas in demand. While there appear to be none being offered, traders might offer up to £400/t ex farm for immediate uplift. Demand is believed to be mainly for niche animal feed markets and bird feed.

There are new contract opportunities for crop 2024 remain, at up to £430/t ex farm subject to buyers terms.