PULSE MARKET UPDATE - April 2023

The Pulse trade since the start of the year has been relatively stable, opportunities were limited and following wheat futures, feed prices fell. Demand for pulses has however picked up a little in recent weeks and prices have stabilised over the last month.

It is well known that values for agricultural commodities worldwide, take no account of the rules of inflation to which other aspects of businesses and regular consumers are subjected. For commodities the basic factors of supply and demand drive values over all other influences. It is for a large part this reason, why crop area ahead of harvest is always a hot topic - it is a significant figure in the estimation of the supply side of the trading equation.

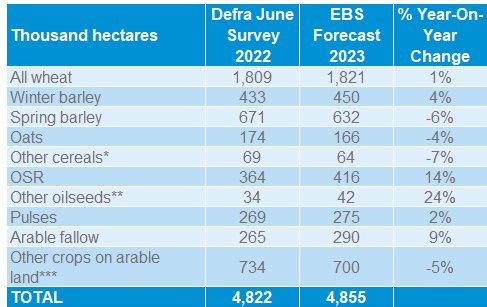

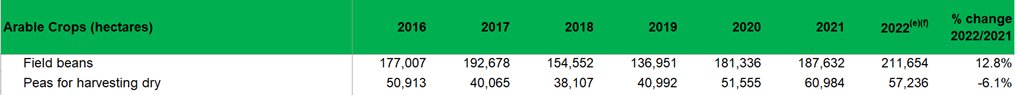

DEFRA STATS from the 2022 harvest suggested a UK bean area of over 211,000 ha and the AHDB early bird survey of December 2022 indicated a planting intention for a 2% increase in pulse crop production for 2023 - potentially 215,000 ha of beans. Neither survey provides a split between the Winter and Spring types and intentions of growers change with other crop fortunes, weather and alternative cropping opportunities, so essentially this is the firmest figure available. Individual companies will make judgements as the season progresses, estimates of seed sales and home saved seed, knowledge of contracts established and the ups and downs of the fortunes of other crops all contribute to the perceived wisdom.

All of this helps set the scene and the estimating continues, through the spring sowing period to be later multiplied by the estimated average yield for the season. The area figures are not confirmed until the autumn after harvest when the DEFRA June survey is published and there is of course no agreed average marketable yield figure collated anywhere. Pulse crop supply is a guessing game of best judgements.

Demand is governed by perception and forecasting too. Interpretations of the direction of the consuming markets and the alternative products and their supply, compete for attention with comparative values.

Getting the picture right is the aim of the trader. Money is made between the buying and selling and equally the marketing of farm produce at the right time can make a huge difference to farm profits.

The UK winter bean crop has increased in size and the wet weather and late exposure to severe cold has put some crops in a difficult position. Chocolate spot is establishing in the wet conditions and growers will need to act to control it early. That said the majority of crops are looking good. It is too early to meaningfully comment on the prospects of the spring sown beans and peas, other than to note that a proportion of growers who missed the excellent soil conditions in February, have had to contend with wet conditions in March. Sowings have been delayed as a result, but to suggest any impact on harvest at this stage would be premature.

UK Pulses

Feed beans

Following the movements in other commodity products, changes in bean values since harvest have been huge. Wheat values fell dramatically, and up to a month ago the bean values had fallen with them. Since then, wheat has continued to fall but bean prices have stabalised and are, at least temporarily, now on a trend of their own - balanced more by the rising values of alternative protein sources such as soya. Current values are in the region of £220/t ex farm, which represents good value against alternative sources and while demand is weak, it has seen some UK buyers returning to the market for their smaller summer requirements.

UK domestic requirements are increasingly being supported by production contracts in the animal feed sector, which incentivise environmental initiatives such as the removal of soya from the supply chain, thus favouring alternative protein sources such as rape seed meal and pulses.

In recent seasons there has been an increase in the export of feed beans to European destinations and while this season may not yet be a record breaker the numbers remain healthy. Export of beans had previously been associated predominantly with human consumption markets, but while immediate trading activity is modest, other destinations are increasingly important. In the calendar year 2021, HMRC data reports exports to the EU exceeded ‘other export destinations’ for the first time.

Stock is still believed available, unsold on farm, but origination offers are slowing and it is thought that the bulk is now completed. If significant farm stocks materialise, there may be a small carry over for the first time in many years.

There is almost no trading of new crop 2023, which at this stage in the spring is quite unusual. Domestic and export buyers are sitting on the fence having been exposed to significant swings in values from crop 2022.

Human consumption bean exports.

The markets have over the last 14 months or so been heavily influenced by the conflict in Ukraine which has had wide reaching effects outside the geographical area, further impacting the already precarious economies of the major destinations of beans for human consumption, in Egypt and Sudan. There, the economies are struggling to access foreign currency for payments, and the risk for trade is significantly increased. This economic factor seems unlikely to change any time soon.

The quality of UK beans from crop 2022 was generally inferior to the early samples from the large Australian harvest, which continues to be offered at a discount to European production. Late flooding in Australia also had an impact on their crop quality and values are falling further as the quality offered declines.

Only a few cargo’s have been shipped / will be shipped, from the UK this this season, and with still inflated values for feed beans, even good quality samples will struggle to reach even a £10/t premium. This market is effectively now closed to crop 2022.

The Egyptian harvest has just begun and is expected to yield 100-150,000t, with a local retail value of US$600 - US$650/t

UK combining peas

2022 crop pea prices have appeared to be on a course all of their own. They rose rapidly with other crops over a year ago but have not fallen back. This is also a factor of supply.

The same DEFRA statistics suggest a significant increase in crop area from 2022 but unlike the bean area the accuracy of this is strongly doubted by the trade. It is wildly different to any estimations of seed sales and farm saved seed, and combined with availability post-harvest, the suggestion is it could be up over-estimated by to 50% .

International demand for peas has risen significantly and world-wide traded values have helped to establish a higher base line under feed values, unusually continuing to support them at a higher level than beans.

While we focus here on crop 2022 values and crop 2023 sowings, the options for crop 2024 contracts are expected to be released soon, for which early indications suggest values will continue to remain very attractive.

There is optimism in the pea sector.

Green peas

Quality judged by colour retention is the main driving factor and good quality open market samples could attract prices in the range £300 - £320/t ex farm.

Lesser quality samples will trade in a range below this, down to a level for feed peas at around £245/t.

Pea prices have held up despite falling values for other commodities, a general indication of shortage of supply.

It is believed that contracted areas for crop 2023 have increased slightly, and even now contracts remain available for very late decisions.

Marrowfat peas

There have been few if any off contract marrowfat peas available for months, but if farms with any of good quality to sell you could receive offers of £600/t ex farm or more.

Contracting continues to improve over the low of two harvests ago and is expected to rise again this coming year, although will likely remain below the target for the trade. Contract offers have been reported numerous times in previous editions of this bulletin.

Yellow peas

Yellow peas continue to command good prices as demand continues to increase. Quality here is predominantly judged by their soaking ability rather than colour retention. Good quality samples will attract similar offers to good quality green peas.

DEFRA STATS (agricultural-land-use-uk-june22-20dec22)

AHDB Early bird survey – December 2022 https://ahdb.org.uk/cereals-oilseeds/early-bird-survey