PULSE MARKET UPDATE - October 2023

Commentary

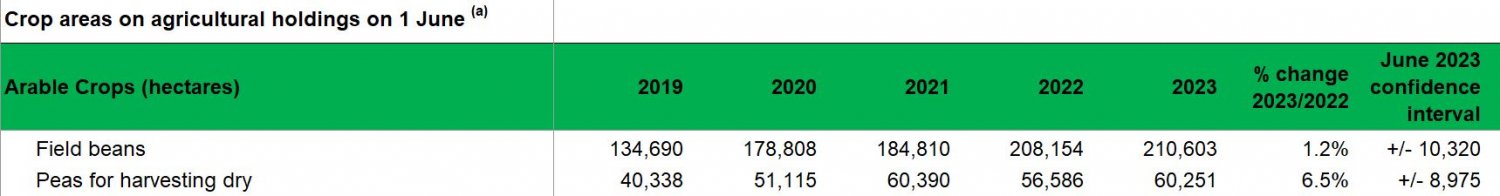

The DEFRA figures for the crop area in England have been released and there is a degree of uncertainty as to whether there was an increase in 2023 or not.

The actual figures show a small increase of 1.2% for beans and 6.5% for peas but given that there is a significant confidence interval for both it seems likely that crop area 2023 was very similar to that of 2022.

Immediately prior to harvest when the July edition of this bulletin was released the market had been quite flat for some time with little to report. We reported that crops in general were looking good, and that harvest 2023 could be above average.

While there are those that have indeed done well, with good yields and excellent quality, it is fair to say that the excellent visual appearance of the crops from the farm gate prior to harvest somewhat flattered to deceive. The largely wet summer did nothing to compensate for the short hot period in June that coincided with flowering of many crops and while there were few issues with grain fill quality was somewhat spoiled, through pod splitting and subsequent weathering of exposed grains, for many who did not prioritise the bean harvest.

The roller coaster that was the weather pattern for crops in 2023 did not always do pulses any favours and the feeling now is that national yields will be below the five year rolling average this year with a very wide range of experiences at individual grower level.

Given the crop area is similar to last year with yields likely to be at a lower level, supply is also likely to be tighter.

Reports of the prospects from Australia this year may hearten those seeking to compete in export markets for human consumption, as following two or three years of record-breaking yields, a lack of water in the main producing areas looks likely to have a significantly negative impact upon their yield potential.

Alternative suppliers with Baltic origin beans are believed to have had similar issues to the UK this year but as usual are in the market at a lower price level for the early export sales opportunities.

It is too early to hazard a guess at the likely crop area for 2024, but the ideal sowing period for winter beans is upon us.

UK Pulses

Feed beans

While in general wheat prices and values for other commodities have fallen significantly over recent months, the value for beans has held up remarkably well.

Immediately post-harvest, this is believed to be as a result of short sellers making good their positions. However, with plenty of beans available at this time, and the reality that many alternative mid-range protein sources, such as imported distillers grains, and rape seed meal, are now significantly better priced per unit of protein, it remains uncertain whether current levels will be sustained.

The current ex farm values of around £225/t are starting to look high and feed manufacturers with ingredient discretion are excluding beans from the ration in the short term.

Initially driven by higher end consumers, the trade is seeing a clear demand in significant parts of the retail sector for soya substitution in animal and feed, and UK produced beans are an excellent candidate for its replacement.

Export demand for UK feed beans is lower than at this time last year, possibly due to competition from Baltic sources immediately post-harvest and relatively high values.

Human consumption bean exports

In recent times there has been a significant decline in UK export activity to Egypt and North Africa. A reduced supply of good quality produce and expected values has combined with significant political, economic, and financial factors affecting the region.

That said there is interest from importers in UK produced beans and a limited number of cargos are being prepared for export.

Reports are that regionally there are significant pockets of good quality beans to be found in the south and midlands, but as usual there are more of the required specification from producers in the northern half of England. The variety Yukon has been specifically mentioned in the trade for its excellent visual appearance for this market this year.

For those with good quality samples suitable for this market there is currently a premium over feed beans of perhaps £25- £30/t ex farm depending upon location.

UK combining peas

The story for peas is similar to beans. Yields have generally - but not universally - been disappointing and quality, while initially considered to be good is also problematic with a wide variation. Some crops have significant waste and stain issues and the presence of virus also detracting from good quality visual appearance.

Peas failing to make the grade for human consumption will end up in animal feed with a current value of around £230/t ex farm depending upon location.

In general pea values are relatively high and it is anticipated that they will fall as trading of the current crop develops and especially when harvest 2024 approaches.

Green peas

As always values vary across the quality range, offers of between £310- £340/t ex farm depending upon location might be expected. Immediately post-harvest there were some parcels traded at higher values, but these offers have now disappeared from the market place.

Contracts for spring sowing 2024 are now available. Minimum Maximum £300 - £400/t ex farm with various optional clauses.

Marrowfat peas

Supply appears likely to be tight until harvest 2024. With most crops grown on contract, market values are perhaps of little immediate relevance, but for those few with a good quality sample on the open market a value of around £550/t ex farm might be realistic at this time.

Good quality is represented by an unblemished visual appearance, freedom from waste and stain and ad-mixtures, minimal bleaching (below 10%) and good soaking and cooking characteristics.

While contracting for crop 2024 has been going extremely well with the crop area likely to increase. Some contracts remain available at around £500/t ex farm.

Yellow peas

Yellow pea prices have recently been boosted a little by the knowledge that the Canadian market is slightly short and enquiries forthcoming.

Issues have been seen this year with high levels of waste, and skin splitting/peeling which will detract from the value.

Trades have been taking place at between £290-320/t ex farm.

Contracts for crop 2024 are still available but are limited.

Maple peas

After a couple of years of oversupply, the variety Mantara is in demand with increasing export interest. It is believed there is little or none available on the open market and a decent open market sample could fetch up to £350/t ex farm.

The variety Rose, while of similar or slightly higher current value on the other hand, is well supplied with little current buyer demand.

For contracts for 2024 contact your merchant.